Typically, you will receive the funds immediately in your bank account, and the repayment is automatically deducted from your next pay. Alternatively, depending on the provider and the amount of money you’ve borrowed, you may be able to spread your repayments over several paydays. The instant access to funds and automatic repayment makes the process of receiving a cash advance quick and easy, reducing the need for credit cards and therefore, reducing the likelihood of falling in a debt cycle.

A pay advance service differs from payday loans as this service doesn’t apply interest rates to your repayments. However, you will pay a fee for each transaction – depending on the pay advance app, the fee can be up to 5% on the borrowed amount (be sure to check the specific terms and conditions of your provider).

Advance wage service type #1:

Direct to consumer Pay On-Demand: As described in the above sections, these are loan-based services that enable individuals to receive a cash advance, with a maximum limit, and pay a flat fee (usually 5%) on the money borrowed.

Advance wage service type #2:

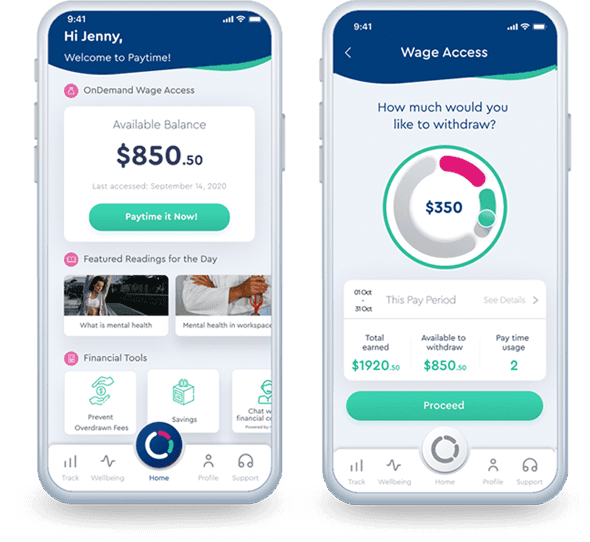

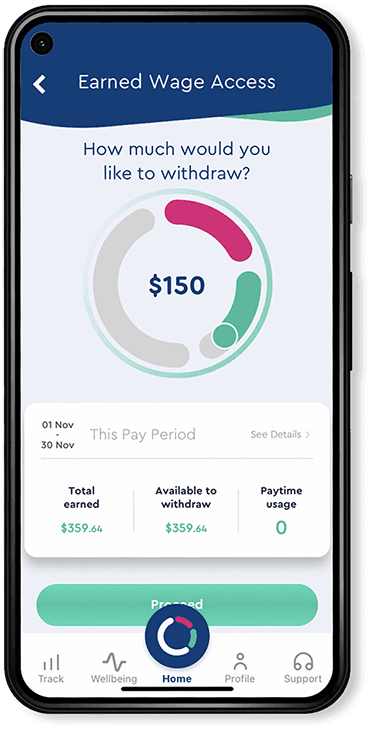

Employer-sponsored Pay On-Demand (Earned Wage Access or EWA): This service, such as Paytime’s Pay On-Demand, is a new cash-advancement method in the Australian economy and is provided by your employer (via a third party). It enables employees to access their earned wages anytime before payday. The amount withdrawn will be automatically registered as a deduction in the employees’ payslip, to be taken out on payday at the same time that the remaining amount is paid out to you. The best part about this employee benefit or wage advancement service is the lack of fees or interest needed to access the money you’ve already earned. Therefore, this unique service provides all the benefits of a traditional cash advance, without any of the negatives.