When you’re in a pinch, short-term loans seem like a good idea. Although they promise a short-term cash fix, they too often become a ‘debt hangover’ leaving you wondering where you went wrong. While short-term cash loans, often referred to as payday loans, can be a helpful tool when used correctly, you need to be aware of the details and responsibilities involved, as well as the alternatives available.

Payday loans are some of the most expensive personal finance options you’ll come across, so it pays more than anything to do your research and shop around for the best solution. In this article, we’ll take a look at the fundamentals of payday lending, the risks involved as well as a meaningful alternative, pay on demand, that takes a different approach to bridge short-term cash issues in a more sustainable manner.

A payday loan is a type of credit whereby the borrower must repay the loan within 12 months and often much shorter. Some payday loans must be repaid in as little as sixteen days, in line with the pay they receive from their employment (hence the name). In turn, payday loans are only offered to borrowers with a job that they can verify.

Each provider (such as Credit24) varies with the terms that they offer; however, there are strict limits on what fees can be applied and what interest is chargeable. For instance, borrowers can apply for loan amounts of no more than $5,000. The borrower is usually charged a base 20% ‘loan establishment’ fee, in addition to a monthly interest charge. The limits are put in place by ASIC, which has a role to play in regulating the fair financial play of lenders in Australia.

The maximum interest charge (or ‘service fee’) is 48% per annum, or 4% a month (based on the principal amount borrowed). Given this fee is capped, most providers will simply charge the maximum amount. Some will offer cheaper alternatives, but they come with their own requirements that you will need to check on an individual basis. It’s also important to remember that although payday loans are unsecured, often the lenders (esp. Offline payday loan providers) may ask to hold a ‘deposit’ in the form of a valuable asset owned by the borrower. In practice, this means that non-payment will result in a serious mark on your credit report, as well as putting at risk any assets that you have provided them.

Payday loans are an expensive type of loan, and they’re best used for fast money needed to settle bills you weren’t planning for. If used long-term, there are many risks that may arise, primarily from the high fees and structure of the industry.

If you cannot make a repayment on time, you will be liable for default fees and enforcement expenses (to cover the cost of recovery). Under the current law, the maximum you can be charged is double the amount you borrowed – which is still a hefty amount!

Whether or not payday loans are good or not depends on your situation, but it is almost certainly bad compared to other alternatives in the market. As a short-term or once-off financial fix, then they can certainly help in a bind. If you find yourself returning repeatedly, it’s a better idea to consider a more sustainable alternative.

Longer-term options include effective budgeting, secured credit from a bank, savings, and borrowing from family and friends. During this process, there are other, better alternatives to payday loans that may work better for you – one of these options is ‘Earned Wage Access’.

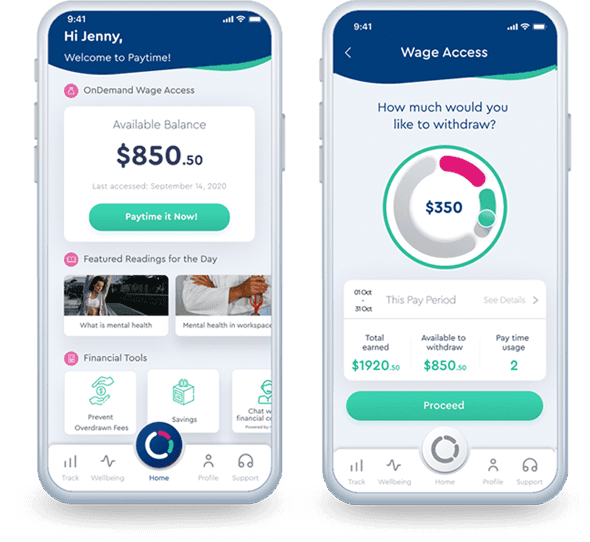

Earned Wage Access usually comes in the form of a simple-to-use app that give employees quick access to a part of their next paycheck. These apps will connect to your employer’s payroll and time-and-attendance systems in order to calculate how much wages you have earned, and therefore be able to withdraw.

Users can only access a portion of the amount that they have already worked for (and therefore earned) but not yet paid. This amount will later be deducted from your payslip on payday, and you will receive the remaining amount. As such, it is not a loan – and there will be no credit checks done nor any impact on your borrowing capacity from utilising Earned Wage Access.

Since this service is put into place by your employer, you first need to check if your employer offers this kind of service within the organisation. If it does not offer Earned Wage Access, we encourage you to reach out to HR and tell them that you would like this solution to be offered to you and the rest of your colleagues. An example of such a provider is Paytime, so by providing HR (or your CFO) with the details then they can be fully informed. At the same time you as an employee of the company should also contact the Earned Wage Access provider (like Paytime) directly, for them to also reach out to HR to arrange a free consultation on the solution in order to get it implemented in your company.

In addition, as it is an employer offered solution and is not a loan, Earned Wage Access is far cheaper and more efficient than any other types of finance. At times, this solution can be offered for free to the employee when subsidised by the employer, as an employee benefit.

There are huge differences between the two. Payday loans are short term loans that charge interest and high fees and can get people stuck into debt, whereas Earned Wage Access is the ethical alternative. Earned Wage Access is not a loan, as it simply allows you to access a portion of your wages that you have already earned, but not yet paid.

Earned Wage Access is the better option as it promotes a more sustainable approach to achieve financial wellness and stay out of debt. Earned Wage Access is not a loan, there’s no interest charged and there is nothing to repay.