Direct to consumer Pay On-Demand:

These are loan-based services that allow employees to borrow up to a maximum percentage of their paycheque or a maximum dollar amount ahead of their payday for a fixed percentage of the loan amount (usually 5%). Employees / users will then have to repay back the amount (plus the fee back) on a pre-agreed date, usually on the next payday, as providers are increasingly trying to match this with the employees’ usual payday, to reduce their risk of bad debts. It should be pointed out that these such loans are based on wages yet to be earned, so the provider is assuming the user is going to work between taking out the loan and the next payday in order to repay it.

Employer-sponsored Pay On-Demand (Earned Wage Access or EWA):

These are services provided by your employer (via a third party) to enable employees to access their earned/accrued, but not yet paid wages through an app, anytime before payday. The amount withdrawn will be automatically registered as a deduction in the employees’ payslip, to be taken out on payday at the same time that the remaining amount is paid out to you. It is akin to the employer running payroll whenever the employees need to access their wages (its like running payroll every single day) – and it is not a loan, there are no interest charges and there is nothing to repay. This is the healthier, and more ethical alternative of finance that can help people avoid the debt spiral and reliance on predatory lending.

There are huge differences between the two offerings, below is a table that summarises the differences:

It is not offered through your employer.

You can easily sign up via their app and access the cash within minutes without having to disclose your employment information

The available balance you can withdraw does not correlate with how much you have actually worked.

After all, it’s a loan that you are taking.

You have the responsibility to repay back the loan

to the provider, directly from your bank account either via direct debit (set up by the provider), or a transfer

Your pay amount in your payslip does not change

even after you have ‘advanced your pay’.

The fees are a percentage of the withdrawn amount

(e.g. 5%).

3rd party Payslip-based consumer credit apps:

These apps, such as Beforepay and MyPayNow, are classic pay on demand services that lend money before your next payday, without the employer’s involvement. These apps will ask the user to provide access to their bank account information, so the provider can view when and how much the user gets paid from their employer. Based on this data, the app will allow employees to borrow up to a quarter of their typical pay amount and up to $1,250 ahead of their payday, for a hefty 5% fee (equivalent to 60-120% APR).

Traditional Payday / Personal loans:

The biggest incumbent here is the group of payday lenders or consumer lenders all across the country charging high interest rates and penalty rates. They often have the easiest onboarding process, but also the highest interest rates. There are many of these around including ASX listed companies.

Bank Payslip-based consumer credit apps:

These services are offered by banks to their customers. Products like CommBank’s AdvancePay make it easy for employees to access funding fast via their mobile banking app. There are fees and charges and may also be interest charged on these loans so be wary. The onboarding and user experience is very similar to apps provided by non-bank vendors, above.

It is featured in your employer’s staff communication.

Since it’s an employer- sponsored service, they will certainly want you to know about it. Watch out for posters, social media posts, internal emails, and announcements from your company.

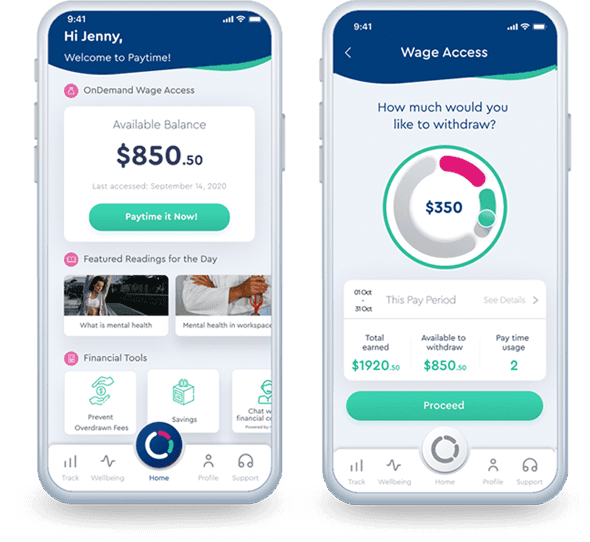

The available balance you can withdraw will depend on how much you have actually worked.

If you are a full-time salaried employee, it will depend on how many work days have passed since the last payday. If you are an hourly employee, it will depend on how many shift hours you have worked. After all, you can only access what you have earned and worked for. If you have not worked a shift / work day since the last pay day, then the available balance will be zero. The available balance changes each day/hour that you have worked – it updates in real-time.

You do not have to repay the amount taken.

On payday you will simply receive the remaining balance of your pay, after deducting any wages/salary amounts you have accessed during the month (before payday). This way, there will never be late fees, interest charges nor do you have to pay anything back.

The fee charged is not correlated with how much you withdraw.

It is a fixed fee (like an ATM fee), that can even be waived (i.e. for free) if the employer decides to subsidise the cost, as an employee benefit program, but if not then you will be charged a fixed dollar amount regardless of how much you withdraw.

Earned Wage Access usually comes in the form of a simple-to-use app that give employees quick access to a portion of their next paycheck. These apps connect seamlessly to your employer’s payroll and time-and-attendance systems in order to calculate how much wages you have earned, and therefore be able to withdraw, in real-time, during the month.

Download the relevant app (form the Apple of Google play store) and sign up for an account (<2min process).

Earned Wage Access has a range of benefits, and it’s always important to understand them in order to understand why it’s such a powerful offering that any company can provide to its staff:

Not a loan to the employees.

Earned Wage Access is not a loan to the employees as they can only access what they have already earned and worked for – what is rightfully theirs. Employees who have not worked a single day / shift will not be able to withdraw anything from the Earned Wage Access app.

An employee benefit that employees love.

As the world moves to a more instantaneous, digital one, allowing employees to access the money that they have earned without forcing them to wait until payday will be something that will be demanded by the workforce. It is their money at the end of the day. Do not be a follower in this field, or else your employees may consider leaving to competitors that offer it first.

A safety net for your employees.

Earned Wage Access is not a solution designed to be used daily. Rather, it is more of a ‘safety net’ that companies can provide to their employees for free that helps them if they’re ever in a cash flow pinch. This way, you can help your employees stay out of predatory lending/payday loans when they are short of cash, and therefore, saving them thousands of dollars in interest, fees and charges.

Configurable guardrails and limits.

The employer has full control on what is considered ‘safe usage’ and therefore can place guardrails and limits as they see fit. For example, the available balance could be set at 50% of employees’ earned wages to ensure that they still have some amount remaining to be paid out on payday. Some employers also can put a limit on the number of withdrawals per month, or a dollar limit per withdrawal.

No manual work, or change to the way companies do payroll.

Leading Earned Wage Access providers integrate their apps and system so seamlessly with companies’ payroll and time-and-attendance software such that there is no need for any manual interventions. All the deductions are posted automatically to payroll, and employees will be paid their outstanding amount automatically on payday. There is simple NO extra work for payroll whatsoever.

No repayment (and recourse) from the employee.

Since no money is being lent, and since repayment is taken care of within payroll (through deductions) – there is no repayment or recourse required from the employee. However some Earned Wage Access providers still do impose a recourse on the employee, such that they have the right to debit the employee’s account. Reading the fine prints carefully will help you understand what the implications are for your employees, make sure you choose a provider that does not impose any recourse on the employee to repay anything, ever!

Ensure the provider has a holistic approach to financial wellbeing.

Does the provider focus only on Earned Wage Access, or does it also look into the broader picture of financial wellbeing? Having access to one’s earned wages is only one part to alleviating financial stress in the workplace. Having other complementary offerings such as access to mental health resources; financial tools and savings plans are all part the overall Financial Wellbeing solution.

Ensure the product is not structured as a loan.

Read the fine prints (for the employee, in the T&Cs) to make sure that the product is not structured as a loan. If it is, it will affect your employees’ credit rating and borrowing capacity. Things won’t look very pretty when they are looking to take out a mortgage to buy a home, as it’s going to be picked up by the bank and will reduce the borrowing capacity of the employee.

Ensure a smooth, automated implementation and integration.

Look for a provider who is capable of integrating their systems into yours in a seamless and automated way such that it will not change the way you currently do payroll.

Easy to use, and intuitive app.

Make sure the user interface for your employees and payroll admin is as intuitive as possible. This will make it easier for you when you need to do any reconciliation and/or monitoring for results.