Whether you’re struggling to pay your bills, have been hit with an emergency expense that you cannot cover, or simply want some flexibility when it comes to your cash flow, it makes sense to have access to your pay when you need it most. Estimates from ME Bank show that over 40% of Australian workers are living paycheck to paycheck – that’s over six million people.

Those living for their next paycheck will find it almost impossible to meet any unplanned expenses that come up and often find themselves at the mercy of bank charges, including late fees, overdrawn bank fees, exorbitant interest costs and more. As a result of not having enough cash to meet their financial obligations, you may turn to credit cards, use the overdraft feature of your transaction account, go for multiple Buy Now Pay Later solutions, or access potentially dangerous payday loans.

There are many ways to access your pay now, although some are certainly better than others. Let’s take a look at a few ways to get access to your pay now, as well as the different options available, including get my pay now apps.

Lots of financial services promise to improve your cash flow today. While this is true for every loan, not all of them have your long-term financial wellbeing in mind. Getting your pay today means missing out on it tomorrow. In many cases it also means a wad of interest and charges to be paid on top. Knowing the different ways to get your pay now allows you to make a choice about which option is best for you. Here are three ways to get the money you need, sooner than your payday.

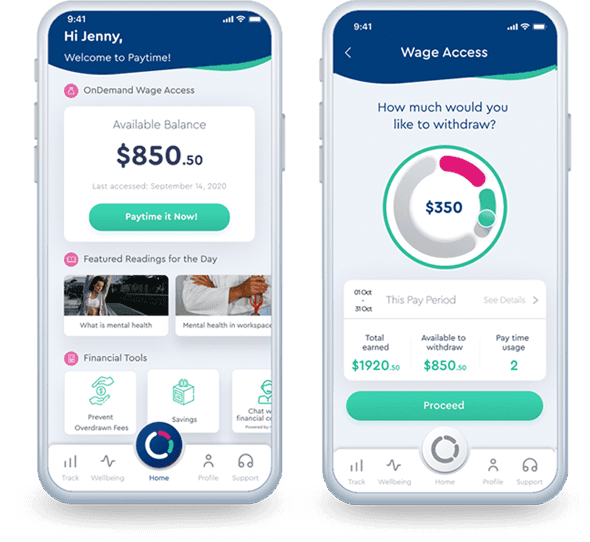

Earned Wage Access is offered by companies to their employees via an app that is seamlessly integrated into payroll software and time-and-attendance systems. The app is able to extract how many hours/days an employee has worked and, therefore, how much wages have been earned at any point in time.

From the employee’s perspectives, it is very straightforward to use Earned Wage Access when offered by their employers:

Because this service is provided by companies to their employees, employees have to first check that their employer has already partnered up with the Earned Wage Access provider in order to access the service. Earned Wage Access is a far more affordable and efficient way to access short term cash than any other type of finance. This is because the solution is provided by your employer, it comes out of your already earned wages, and is not a loan. Depending on the employer’s stance on employee benefits and hence their staff’s financial and mental wellbeing, this solution can be offered for free to employees under a subsidy or employee benefits model.

Earned Wage Access has a range of benefits, and it’s always important to understand them in order to understand why it’s such a powerful offering that any company can provide to its staff:

Not a loan to the employees.

Earned Wage Access is not considered a loan to the employees as they can only access what they have earned and worked for – what is rightfully theirs. Employees who have not worked will not be able to withdraw anything on the Earned Wage Access app as the balance will reflect as Nil.

A safety net for your employees.

Earned Wage Access is not a solution designed to be used daily. Rather, it is more of a ‘safety net’ that companies can provide to their employees for free that helps them if they’re ever in a cash flow pinch. This way, you can help your employees stay out of predatory lending/payday loans when they are short of cash, and therefore, saving them thousands of dollars of debt and headache.

Prepares you to be a Workplace of the Future.

As the world moves to a more instantaneous, digital one, allowing employees to access the money that they have earned without forcing them to wait until payday will be something that will be demanded by the workforce. Do not be a follower on this field, or else your employees may consider leaving to competitors that offer it first.

Configurable guardrails and limits.

The employer has full control on what is considered ‘safe usage’ and therefore can place guardrails and limits as they see fit. For example, the available balance can be set at 50% of employees’ earned wages to ensure that they still have some amount remaining to be paid out on payday. Employers also can put a limit on the number of withdrawals per month, or a maximum dollar limit per withdrawal, if they feel it necessary.

No manual work, or change to the way companies do payroll.

Earned Wage Access providers integrate their apps and system so seamlessly with companies’ payroll and time-and-attendance software such that there is no need for any manual interventions. All the deductions are posted automatically to payroll, and employees will be paid their outstanding amount automatically on payday.

No repayment or recourse back to the employee.

Since no money is being lent, and since repayment is taken care of within payroll (through deductions) – there is no repayment or recourse back to the employee. However some Earned Wage Access providers still do impose a recourse on the employee, such that they have the right to debit the employee’s account. Reading the fine print carefully will help you understand what the implications are for your employees, so be careful to choose a provider that does not require any repayment of the funds from the employee nor recourse back to the employee, in the event that the employer does not repay the Earned Wage Access provider on payday.