In today’s current economic climate with record-high inflation rates, unfortunately the financial wellbeing of Australians nation-wide is declining. Given the likelihood of worsened financial situations over the next 12 months, it’s crucial individuals educate themselves on the various cash advance solutions available to them and how to best select a service that considers the long-term financial wellbeing of the consumer.

Many advance pay services advertise their ability to improve your cash flow today – quickly and easily. The most common financial service for quick cash is a short term loan, also known as a payday loan, that gives you a ‘cash advance’ ahead of your next pay date. After completing your application form, if approved, the service can turn the loan around within a business day (some services conduct credit checks first). Whilst this may sound appealing to some, this service comes with fees and charges, high interest rates and low repayment windows, meaning, when your next payday arrives you may not be able to cover your standard bills along with the fees associated with your loan amounts.

This is the beginning of a debt spiral or debt trap – in order to pay off personal loans you may need to open a credit card or use another cash advancement service. Once a debt cycle has begun, it can be extremely difficult to overcome.

In today’s technological era there are undoubtedly multiple apps that promote pay-day advancement offerings. Typically, these services connect directly to your personal bank account and automatically withdraw the amount borrowed on your next payday. Basically, you’re able to access your pay early through payday cash loans. Whilst this offering is simple to use and automatically deducts the money owed from your next paycheck, these services still run on credit and charge a 5% fixed fee on the borrowed amount.

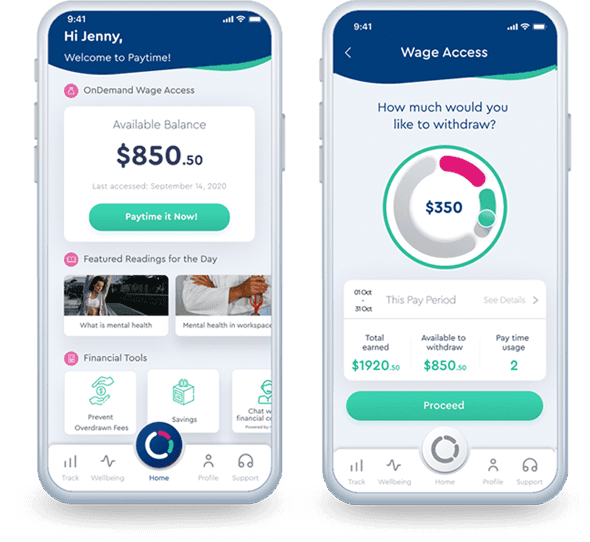

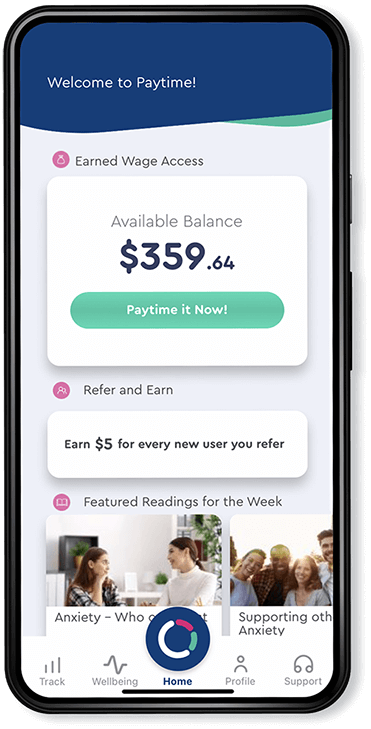

Unlike loans or payday loans, Paytime’s on-demand service provides you with early access to cash you’ve already earned. How? Simple. Instead of waiting for a weekly, fortnightly, or monthly payday, you have a consistent, positive cash flow. Everyday becomes a pay day with early access to your pay.

To explain, we’ll use an example. Let’s say you work a standard eight hour day. With Paytime’s service, at the end of the day, you’ll have access to eight times your hourly rate. You receive access to your pay as you earn it, in real time, instead of waiting for a single pay day. Dissimilarly to other app financial offerings, earned wage access breaks the pay cycle by providing you with daily cash inflow, which in turn better equips you to manage unexpected bills and set a realistic budget. What makes this offering superior is that it comes at no charge. There is no fixed fee or high interest rate. Therefore, Paytime’s on-demand pay, or earned wage access, eliminates the potential of falling into a debt spiral and empowers you to better manage your finances.

We’re on a mission to improve the financial wellbeing of Australians and encourage all employers to provide their employees with earned wage access.